Long vs Short Trading Explained

What Going Long or

Short Means

This article will cover the basic concept of long and short positions. To continue with this topic we must agree that when trading, essentially you only have two options. You are either buying or selling.

To keep things simple, going long means buying and going short means selling. Trading fundamentals state that you will buy something when you expect the price to go up and you will sell something when you expect the price to go down. These are the core principles of trading.

Now, in terms of forex, the same principles apply. You will enter a long position (buy) in one currency vs another because you expect the currency you are buying to go up in value. When you are going long (buying) on EURUSD, you are essentially buying Euros and selling US Dollars. So if you are going long, you have an expectation that the Euro will get strong against the US Dollar.

The opposite is true when entering a short position (selling). You will enter a short position (sell) in one currency vs another because you expect the currency you are selling to go down in value. When you are going short (selling) on EURUSD, you are essentially selling Euros and buying US Dollars. So if you are going short, you have an expectation that the Euro will get weaker against the US Dollar.

When to Go Long?

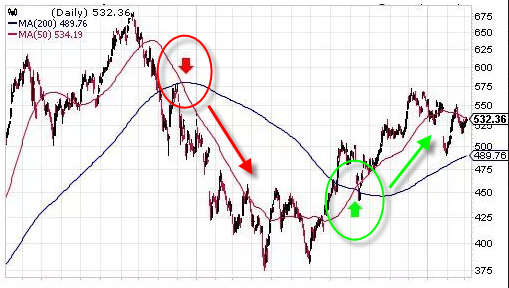

Traders will spend hours on end to find the perfect trade, a trade they feel is a sure winner. Some traders will use moving averages as a technical analysis to find these perfect trades. A popular strategy that is used charts two moving averages on a given forex pair. One longer (200 day) and one shorter (50 day). The strategy here explains that when the shorter term moving average crosses above the longer term moving average, it is a buy signal. As explained above, going long (buying) is a trade where the trader has an expectation that the pair they are trading will go up in value. So in this case, as a trader, you spot the crossover in the moving averages and you have an expectation that the price will move up, and at this point you enter a long trade. As the price starts to rise, you will make a profit.

The Forex Exchange Market is a versatile market that allows you to speculate on the price of the currencies, without having to physically exchange or deliver the underlying currencies physically at a settlement date.

However, in the underlying market, spot Forex transactions are settled within 2 business days after the trade date. It means, if a financial institution buys EURUSD, they’ll receive euros two days after the execution, since that’s how long it takes to transfer funds between bank accounts.

As the forex market is based on spot contracts and allows leverage, the broker acts as a counterparty, rolling over your positions and calculating funding charges as a substitute of the delivery of the physical currencies. This means that if rollover didn't happen, traders would have to sell or buy your existing contract every 2 days.

In order to allow for a seamless trading experience, banks do this on traders’ behalf and charge the swap/rollover fee. To pass on this cost, swap fees are implemented. Its origin is in the Interbank Market, and the interest rates paid (to be financed) by the countries involved in the currency pair.

The swap fees depend mainly on the difference in the interest rate of both currencies in the pair, when these values are net off, you could be charged or receive a daily amount of interest depending on the position you hold.

If the long currency’s interest rate is higher than the sell currencies interest rate, the position will pay the position’s holder a swap credit. While the swap will be paid (debit), if the short currency’s interest rate is higher than the long currency’s interest rate. For example, if you open a long position on GBP/USD and the GBP interest rate is lower than the USD interest rate, you will pay a rollover fee.

It’s important to note that drastic changes in rollover rates in Forex only occur when there are changes in the countries economies involved in the pair that might increase the credit risk. However, for this reason, it doesn’t mean that a long position, that incurred swap earns today, won’t incur swap debits in the future.

When to Go Short?

On the other hand, the same strategy using the moving averages says, when the shorter term moving average crosses below the longer term moving average, it is a sell signal. As explained above, going short (selling) is a trade where the trader has an expectation that the pair they are trading will go down in value. So in this case, as a trader, you spot the crossover in the moving averages and you have an expectation that the price will move down, and at this point you enter a short trade. As the price starts to drop, you will make a profit.

For more information on long and short positions please feel free to reach out to us. We would be more than happy to discuss with you. Also we encourage you to download our Forex Beginners User Guide.